A year of success for our Corporate Finance Team

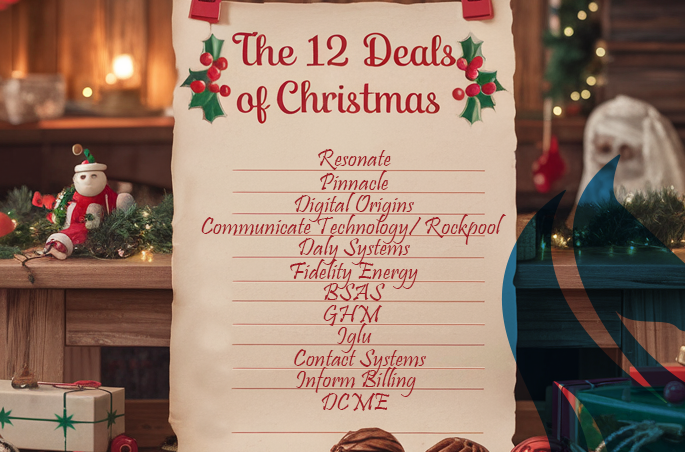

As the festive season approaches, it’s time to reflect on a remarkable year for our Corporate Finance team. 2024 has been a period of exceptional success, marked by strategic deals, strong partnerships, and outstanding results for our clients. From private equity buy-sides to debt fund raises, our team has demonstrated unparalleled expertise across a diverse range of transactions. To celebrate these achievements, we present “The 12 Deals of Christmas,” showcasing the highlights of our year.

This year’s success is a testament to our deep understanding of the market, our commitment to our clients, and the strength of our relationships within the industry. We’ve navigated complex transactions with skill and precision, securing optimal outcomes for all parties involved. We’re particularly proud of the repeat business we’ve secured, demonstrating the trust our clients place in our expertise.

Here are the 12 deals that defined our year:

-

Resonate: Preparation is key, and this deal exemplifies that perfectly. We advised on the successful sale of this Teams integration specialist to SCC, ensuring a smooth transition and maximizing value for our client. Our meticulous preparation played a crucial role in the deal’s success.

-

Pinnacle: This was the quickest process of the year, demonstrating our team’s agility and efficiency. We facilitated the sale of this UC reseller to Focus Group in record time, achieving a swift and successful outcome for all parties.

-

Digital Origins: A testament to the strong relationships we build with our clients, this marked our first repeat client of the year. We advised on the sale of this MSP to US-based Evergreen, further expanding their reach and market presence.

-

Communicate Technology/Rockpool/York Data Services: This complex transaction involved a private equity buy-side followed by a strategic bolt-on acquisition. Our expertise in navigating multi-faceted deals was instrumental in achieving a successful outcome.

-

Daly Systems: This transaction marked our first successful collaboration with OneCom. We advised Daly Systems on their sale, forging a new and valuable partnership in the process.

-

Fidelity Energy: We advised on the private equity sell-side of this MBO with Blixt. Our experience in navigating private equity transactions ensured a seamless process and a positive outcome for our client.

-

BSAS: This deal represented the culmination of a 25-year relationship, a testament to the long-term partnerships we build. We advised on the sale of BSAS to SCG, marking a significant milestone for both companies.

-

GHM: Demonstrating our persistence and commitment to client success, this deal proved that if at first you don’t succeed, try again. We successfully advised on the sale of GHM to SCG, securing a positive outcome after previous attempts.

-

Iglu: This transaction marked our first joint mandate with K3 Advantage, resulting in successful debt funding from Triple Point. This collaborative approach broadened our reach and expertise, delivering excellent results for our client.

-

Contact Systems: Another example of our strong client relationships, this marked our second repeat client of the year. We advised on the sale of this CCaaS provider to Focus Group, further solidifying our position as a trusted advisor in the technology sector.

-

Inform Billing: This deal solidified our reputation as the “go-to” advisor for channel-focused businesses in the ICT sector. We advised on the successful sale of Inform Billing to Giacom, further strengthening their market position.

-

DCME: This transaction marked our first foray into the health technology sector, with a strategic investment from Agilio. This expansion into a new market demonstrates our adaptability and breadth of expertise.

This impressive list of deals highlights our team’s dedication, expertise, and unwavering commitment to our clients. We look forward to building on this success in the coming year and continuing to deliver exceptional results. We wish everyone a very Merry Christmas and a prosperous New Year.

Knight CF was founded by Adam Zoldan and Paul Billingham in December 2008 with the specific aim of advising businesses and entrepreneurs in the technology and telecoms sector. During this time, it has completed 200 transactions from its offices in London and Manchester and is now part of K3 Capital Group, a multi-disciplinary and multi-national advisory Group https://www.knightcf.com/